Stochastic oscillator indicator by developer George Lane, the main idea lies in the fact that price increases tend to close previous highs, and downtrend prices fall to cover nearest and previous lows.

Trading with the Stochastic indicator involves the following signals:

- The Stochastic line is cross indicates a trend change.

- Stochastic above the level 80 means the currency pair indicates overbought.

- Stochastic staying above level 80 means the uptrend goes strong.

- Stochastic out of level 80 downwards means there is a correction or the beginning of the formation of downtrend.

- Same for a level below 20 means an oversold currency pair,

- Staying below level 20 means a strong running downtrend.

- Exiting level 20 and heading up means expecting upward correction or early uptrend.

How to Interpret Stochastic Oscillator Indicator

Stochastic is a momentum oscillator, which consists of two lines: % K – fast line, and % D – slow line. Stochastic oscillator is plotted on a scale between 1 and 100.

There are also so-called “trigger levels” added to the Stochastic charts at levels 20 and 80. The line suggests when the market is oversold or overbought when the Stochastic line passes above the line.

How to Use Stochastic Oscillator Indicator

Let’s look at three trading methods with the Stochastic Oscillator indicator.

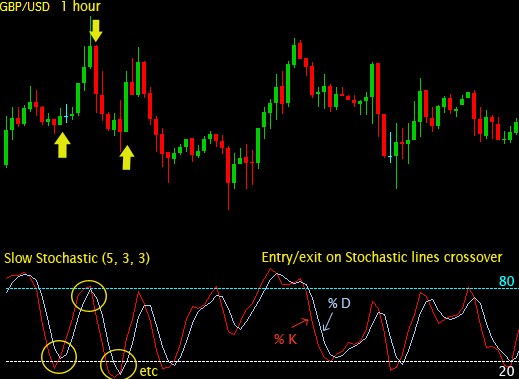

Method 1. Trading with Stochastic line cross

This is the simplest and most common method of reading signals from Stochastic lines as they cross each other. How stochastic % K and % D work is almost the same as the moving average indicator works:

- When the % K line is cross from above the %D line, it shows Sell signal.

- When the % K line is cross from below % D, indicating buy signal.

Stochastic cross lines that occur above the 80% level and below the 20% level are treated as the strongest signals, compared to those outside the level.

Traders can choose their Stochastics sensitivity. The smaller the Stochastic parameter, the faster it will react to market changes, changes in line lines will appear more frequently.

Stochastic sensitivity (eg 5, 3, 3) is useful for observing rapidly changing market trends. But because it is too choppy it should be traded in combination with other indicators to filter the Stochastic signal.

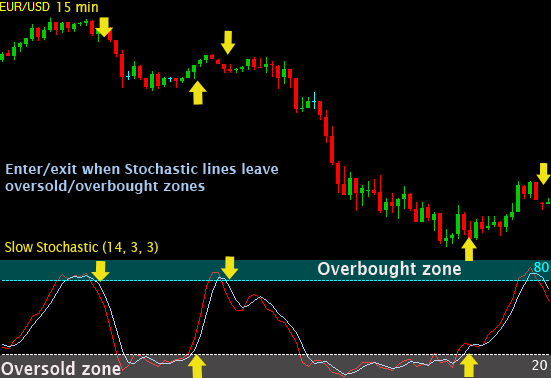

Method 2. Trading Stochastic in oversold or overbought area

Stochastic oscillator by default has an level 80%, above that level is treated as an overbought market, and level 20%, below this level is considered oversold market.

It is important to remember for a sideway price, a single Stochastic cross line that occurs above 80% or below 20% will most of the time result in a rapidly predictable trend change, in market trends can mean nothing happens. When the price trend is good, the Stochastic lines may remain in the overbought / oversold area for a long period of time while the line is there several times.

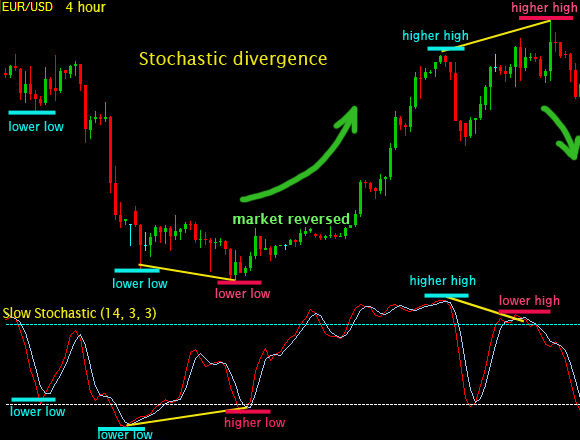

Method 3. Trading with Stochastic divergence

The trader seeks the difference between Stochastic and the price itself. At the moment the price makes a new low price while Stochastic oscillator produces the lowest lower price thus creating the dissonance in the picture. This is called divergence. The difference between price and the Stochastic reading shows the disadvantage of forming a major trend and therefore a possible correction.

Full Stochastic, slow Stochastic, and fast Stochastic,

Full Stochastic has 3 parameters, such as: Full Stoch (14, 3, 3), where the first and last parameter are identical to those found in Fast and Slow Stochastic:

the first parameter is used to calculate the %K line, while the last parameter represents the number of periods to determine the %D – line signal.

The difference between full Stochastics and other Stochastics lies in the second parameter, which is made to increase the leveling quality for the %K line. Applying the smoothing factor allows the full Stochastic to be a bit more flexible for graph analysis.

How to Install Stochastic Oscillator Indicator on Metatrader

To install the stochastic indicator on the Metatrader platform, click Insert => Indicator => Oscillator => Stochastic Oscillator.